Tax firms have a tough job. It's a struggle to juggle staff, projects, clients, deadlines, and expectations. Important data is spread across emails, file management, project management, spreadsheets, tax software, meetings, etc. Things are getting lost, clients are paying the price, and you're overworked and stressed out.

Everything is fighting for your attention. Notification overload, calendar Tetris, constant client requests. You find yourself always overwhelmed.

Streamline how you work with prospects and clients so you can save the weekend and find more billable time. Automate your marketing efforts and deliver personalized content. Schedule client data collection, scale onboarding, anticipate bottlenecks, and standardize common processes.

Yes, it's really that easy to get your weekend back.

Accounting firms rely on too many manual processes, from data entry to client interactions, wasting billable hours and missed growth opportunities. These outdated methods slow down operations and impact your ability to deliver an exceptional client experience.

With workflow automation your practice can dramatically shift this dynamic. Automating tasks like client intake, firms can cut data entry time by over 50%. Marketing tools enable targeting right fit clients, improving conversions and profitability. And a fully managed website ensures a continuously fresh and appealing online presence, drawing in more clients.

Leveraging automation turns time-consuming tasks into efficiency gains, allowing firms to focus on growth and client service.

Streamline your onboarding process with our custom builder to create proposals, engagement let

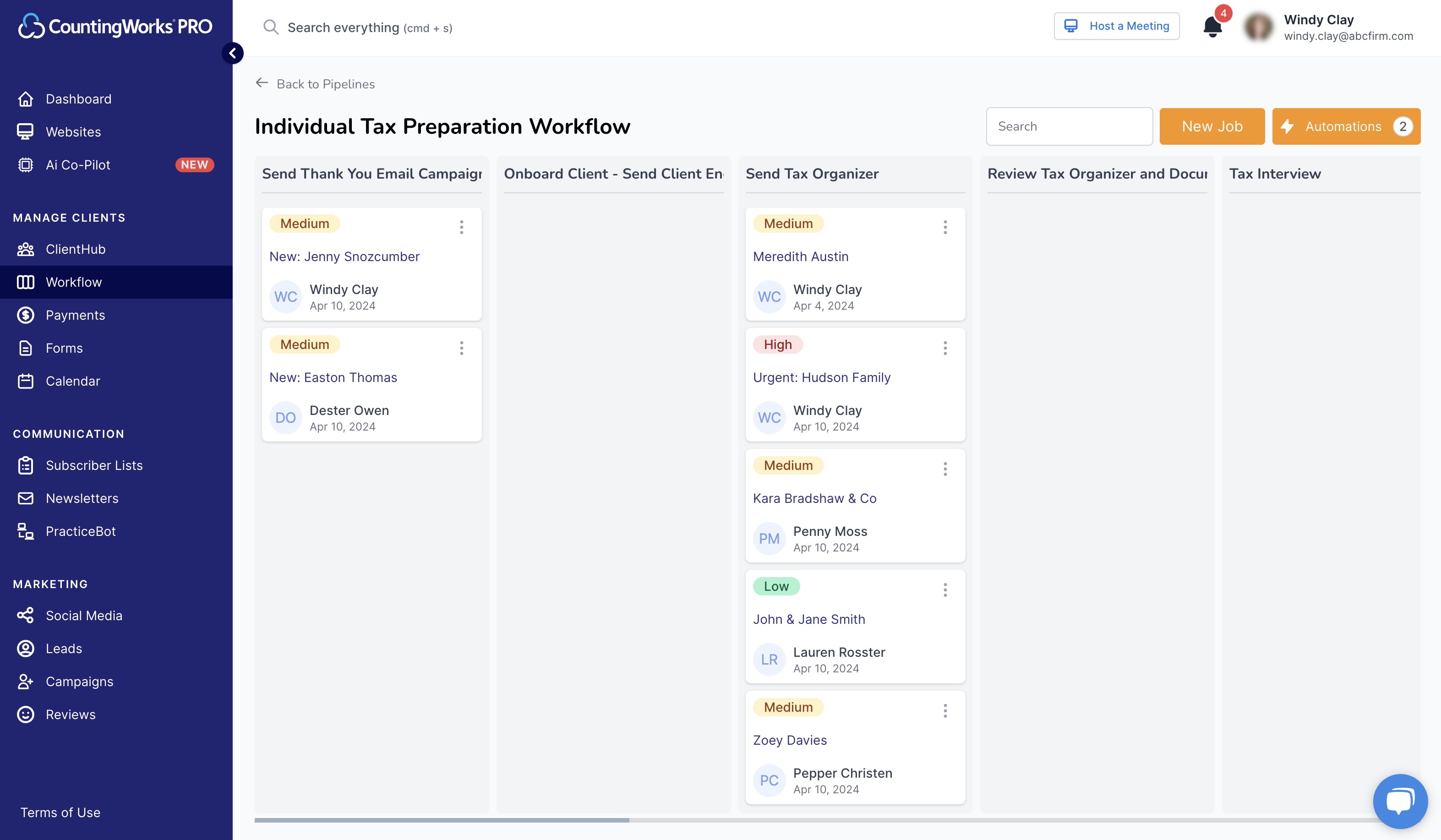

Choose from over 30 pre-loaded workflows to manage and simplify every client interaction.

If you need more staff, our offshore team can provide you with the additional help you need during tax season.

Below is a personalized, year-long tax planning strategy developed by CountingWorks, Inc., specifically for a freelancer earning $75,000 with multiple 1099 clients....

1. Establish a Robust Recordkeeping System

2. Manage Quarterly Estimated Tax Payments

...