The “Great Intentions, No Execution” Problem

Every firm has the same dream:

“Let’s create a campaign to bring in more of the clients we want.”

And then reality sets in:

- Who’s writing the blog series?

- Who’s creating the landing page?

- Who’s scheduling social posts?

- Who’s designing the guide or white paper?

- Who’s running the CRM?

The campaign stalls. Nothing launches. And the firm misses the chance to stand out. That’s the problem playbooks solve.

Agencies charge thousands for what playbooks deliver automatically—content, cadence, and conversion built in.

The Pain Point: Marketing Funnels Are Expensive & Hard

Building an effective marketing funnel—let’s call it what the internet calls it—requires:

- Content Creation: Blogs, guides, white papers, emails, and social posts.

- Design & Branding: Landing pages, calls-to-action, graphics.

- Technical Setup: Email automation, CRM logic, SMS integration.

- Cadence & Timing: Knowing what to send, when, and in what order.

- Cost & Bandwidth: Agencies charge $5k–$10k+ per month to manage campaigns like this.\

For most tax & accounting pros, it’s simply out of reach.

Related: Why SEO + GEO Optimization Is Critical for Tax & Accounting Firms

Why Playbooks Matter in the AI Age

- SEO + GEO Visibility

Playbooks feed Google (and AI search tools) fresh, structured, niche content—keeping you relevant and discoverable. - Client Segmentation

From expats to Shopify sellers to dual-income households, playbooks let you target exactly who you want. - Autopilot Campaigns

Set it and forget it. Blogs, emails, texts, and social posts run automatically, so you stay in front of clients without the manual lift. - Upsells & Cross-Sells

Playbooks like “Tax Prep to Tax Advisory” or “Bookkeeping to Virtual CFO” help firms move clients into higher-value services. - Retention & Referrals

By showing up consistently with useful content, you stay top of mind—making referrals easier and client loyalty stronger.

Your Growth, on Autopilot

What Most Tax & Accounting Pros Get Wrong

- They think “one blog post” = a campaign. (It doesn’t—it’s a drop in the ocean.)

- They sign up for a generic CRM, but never have time to build the funnels.

- They hire agencies that don’t understand tax law—resulting in generic, inaccurate content.

- They run one-off campaigns with no consistency.

The result? Money spent, time wasted, no real growth.

How CountingWorks PRO Fixes This for You

This is where our playbooks are completely different.

- Curated by Experts: Our copywriters + tax professionals design each campaign with technical accuracy and proven marketing cadence.

- Powered by MAX: Our AI engine personalizes every piece—your name, your bios, your niche, your tone, your city. No duplicates.

- Multichannel by Default: Each playbook includes blogs, social posts, emails, landing pages, and even SMS messages.

- SEO + GEO Optimized: Content is built to rank, index, and feed Google’s algorithms.

- Set It & Forget It: Once connected, campaigns run automatically for 12 months or more—feeding your site, your socials, and your list.

- Library of Options: From dual-income households to QuickBooks, expats, e-commerce, IRS tax problems, ADP payroll, and more—we have playbooks ready to launch.

- Affordable at Scale: What costs agencies $5k–$10k/month, we’ve standardized and scaled—baking it right into CountingWorks PRO.

The outcome? Funnels that actually launch, actually run, and actually convert.

Watch: How Playbooks Turn Tax Clients Into Advisory Revenue

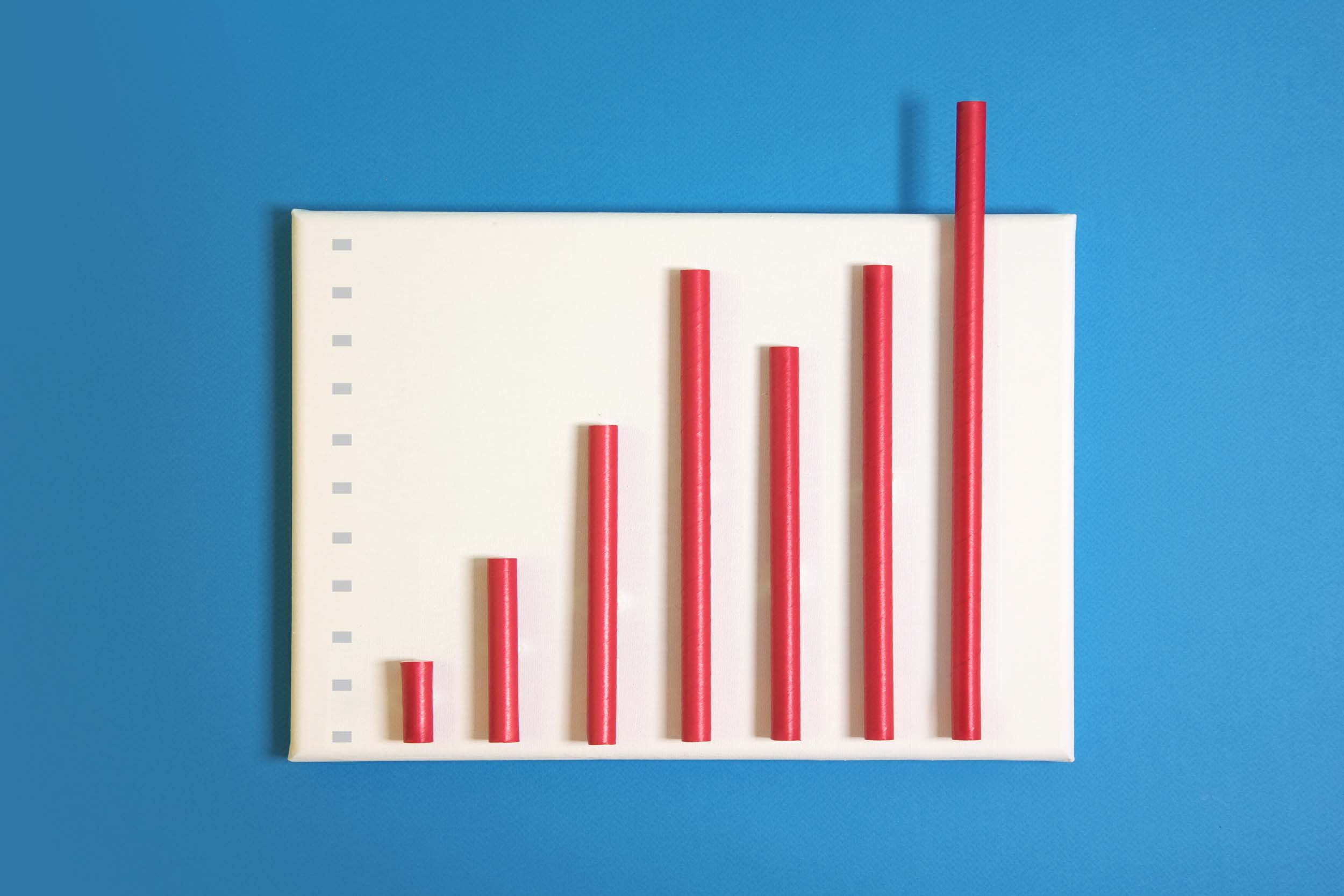

The Bottom Line

Marketing funnels aren’t new. But until now, they’ve been too complicated, too expensive, and too generic for most tax & accounting firms.

CountingWorks PRO playbooks change that. With unique, automated, technically accurate campaigns running in the background, your firm can attract better clients, upsell more services, and grow on autopilot.

👉 Ready to put marketing on autopilot?

.png)

.svg)