Email Is a Dumpster Fire with a Search Bar

Let’s be honest: email is where client attachments go to die.

One day it’s “Here’s my W-2.”

Next day it’s “Oops, wrong one — use this instead.”

Then it’s “Did you get my 1099?” (Yes. Somewhere. Buried between Costco coupons and three “Final Draft” versions of their return.)

Oh — and did we mention? Email isn’t secure. At all.

For tax and accounting pros, email is a compliance nightmare waiting to happen. The IRS knows it. Insurance carriers know it. Your gut knows it.

Why Secure Communication Matters

Here’s the part too many pros overlook: there are actual rules.

- IRS Publication 4557 (Safeguarding Taxpayer Data) makes it clear: you must protect electronic data, use encryption, and limit access to authorized users.

- FTC Safeguards Rule requires firms to implement secure systems for handling sensitive financial information.

- Two-factor authentication is strongly encouraged in IRS guidance, and many state boards require it.

- Insurance carriers often won’t cover you if you can’t prove you followed basic safeguards.

And here’s the stat that stings:

🔒 90% of data breaches still start with email.

That’s why email is not — and never has been — a secure channel for tax documents. Every time you attach a return and hit send, you’re taking a gamble with your client’s trust and your compliance obligations.

Email is where tax documents go to die. ClientHub replaces chaos with secure, organized, compliant communication.

The Old Way vs. The ClientHub Way

Old way:

- Attachments flying around in email threads.

- “Final-final” versions everywhere.

- Paying for a separate e-sign tool.

- Chasing clients for missing docs.

- Crossing your fingers that nothing gets hacked.

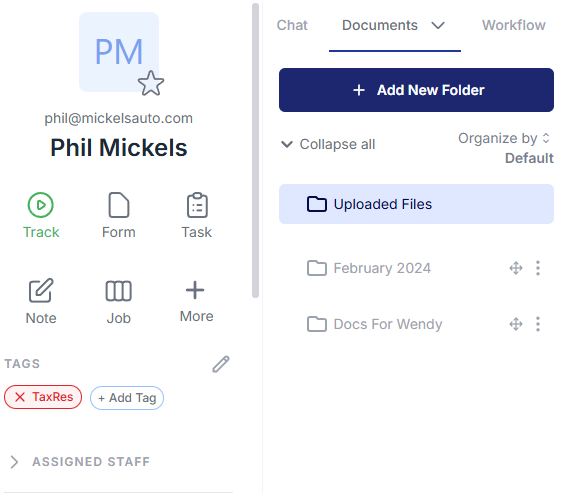

New way (ClientHub):

- One secure place for every file, message, and update.

- IRS-compliant, with encryption + two-factor login.

- Clients log in, sign, upload, and move on.

- You stay organized, compliant, and calm.

Enter CountingWorks PRO ClientHub (Powered by MAX)

This isn’t just another “portal” that clients dread using. ClientHub is where communication actually becomes easier — for both sides.

- AI-powered replies. MAX helps you respond to client inquiries quickly — even pulling tax research into the answer.

- Return summaries. Add plain-English explanations to returns before sending.

- Voice notes. Leave clients quick audio updates, right in the hub. (Think voicemail, but secure.)

- Context everywhere. Because ClientHub houses proposals, engagement letters, and intake forms, MAX can pull client-specific data into every reply, every plan, every document.

The Email Problem, Solved

Time Saved = ROI Earned

Let’s run it out:

- Old way = 5–10 minutes per client email chain just to chase attachments or confirm details. Multiply that by 100 clients → 8–16 hours wasted.

- New way = everything in one hub, AI drafting your replies, instant e-signatures. Multiply that same 100 clients → dozens of hours saved every season.

Add in less stress, fewer mistakes, and higher client satisfaction? That’s ROI you can feel.

The Real Payoff

A secure client portal isn’t just about checking the compliance box. It’s about:

- Staying on the right side of IRS, FTC, and state regulations.

- Protecting your firm (and your clients) from risk.

- Making communication smooth and professional.

- Saving you and your team hours of admin.

- Giving clients a modern experience that feels as good as the service you deliver.

The Bottom line

Email is broken. CountingWorks PRO’s ClientHub powered by MAX makes client communication secure, compliant, and client-friendly — turning your weakest link into one of your strongest advantages.

.svg)